georgia film tax credit application

Production companies sell their Georgia entertainment tax credits to purchasers at discounted rates. This is an easy way to reduce your Georgia tax liability.

Essential Guide Georgia Film Tax Credits Wrapbook

GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project.

/cdn.vox-cdn.com/uploads/chorus_asset/file/19161249/Ringer_HollywoodGeorgia.jpg)

. On average 1 of a Georgia entertainment tax credit may currently be purchased for. FILM TAX CREDIT. 159-1-1-01 Available Tax Credits for Film Video or Interactive Entertainment Production.

Direct contact for an audit. Only production companies are eligible to apply. CurrentHow to Complete the Application.

For example in 2005 Georgia approved the Film Tax Credit to generate revenue and entice film producers to come to the state. 159-1-1-03 Film Tax Credit. The verification reviews will be done on a first comefirst serve basis.

Audits are required for Film Tax Credits based on the date the production was certified by the Department of Economic Development. In 2008 Georgia passed OCGA. Complete the information below listing the primary and secondary representatives who have authority to act on behalf of the firm and who will have.

Audit Application and Reporting. The income tax credit may be used against Georgia income tax liability or the production companys Georgia withholding or. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of.

Mandatory Film Tax Credit Process for Production Companies on the Georgia Tax Center not applicable to Qualified Interactive Entertainment Production Companies 7-8-16 1. Learn about the changes to the Georgia Film Tax Credit scheduled to go into effect in 2021 and new requirements including an independent audit - Atlanta CPA. Georgia Tax Credit Application - Cognito Forms.

The following documentation provides information onreporting film tax credit and applying for. Update June 27 2020 House Bill 1037 sponsored by Rep. 48-7-4026 to further entice.

Click to learn additional information and to obtain the GDORs application form. TABLE OF CONTENTS. 1 Georgia Department of Revenue July 2021.

Matt Dollar R-Marietta requires all. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. Film companies that apply for Georgias film tax credit could face new scrutiny.

Georgia Film Records Blockbuster Year In Fy 2021

Essential Guide Georgia Film Tax Credits Wrapbook

Guest Essay Five Reasons Why Georgia Should Yell Cut On Film Tax Credit Arts Atl

What S Happening In Georgia The Atlanta Film Industry Today Wrapbook

/cdn.vox-cdn.com/uploads/chorus_asset/file/19161249/Ringer_HollywoodGeorgia.jpg)

Can Hollywood Change Georgia Or Has It Already The Ringer

Essential Guide Georgia Film Tax Credits Wrapbook

Eue Screen Gems Film Movie Production Complex In Atlanta Ga Atlanta Hotels Sound Stage Downtown Hotels

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Georgia Senate Panel Proposes 900 Million Cap On Film Tax Credit Variety

Celebrating The Georgia Film Industry Stranger Things Filming Locations Georgia Georgia On My Mind

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Georgia Film And Tv Tax Credit Jumps To A Record 1 2 Billion Variety

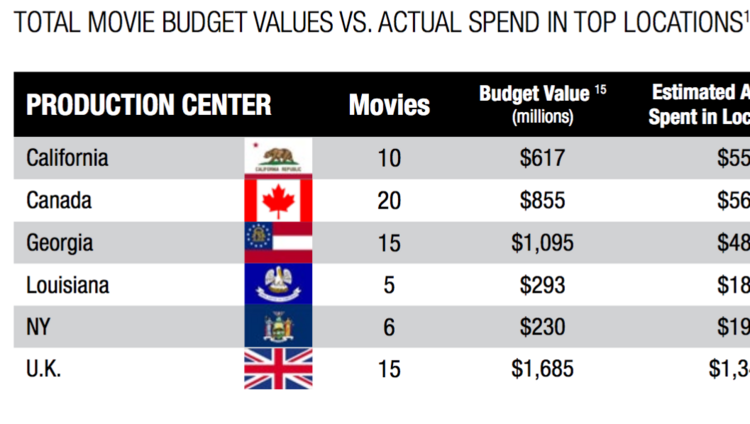

Film And Tv Spending In Georgia Hits 4 4b The Hollywood Reporter

Georgia Scrap Bill That Would Have Capped Its 900 Million Film Incentives Deadline

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

/cloudfront-us-east-1.images.arcpublishing.com/gray/46EMDAS3IVFXTAGTBJU3DQM77Q.jpg)

Competition From Other States Increasing Pressure On Georgia S Film Industry